Applying for a loan from a bank can be a daunting process, but with the right knowledge and preparation, it can be a smooth and successful experience. Whether you need a loan to buy a house, start a business, or pay off debt, this step-by-step guide will walk you through the process of getting a loan from a bank.

Remember, getting a loan from a bank requires careful planning and preparation. By following this step-by-step guide, you can increase your chances of obtaining a loan that meets your financial needs.

Researching Loan Options

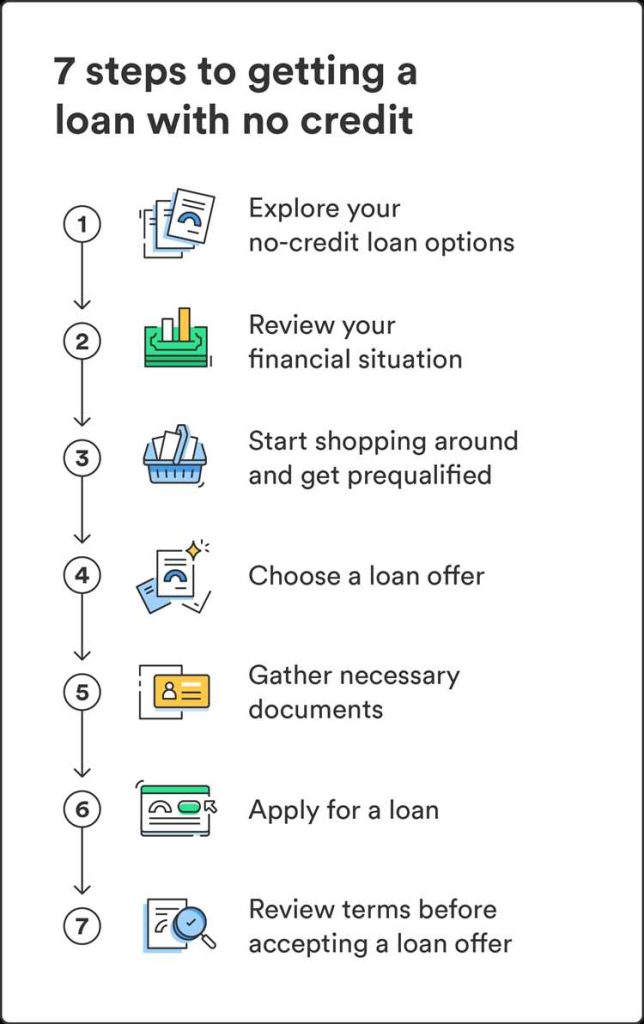

Before applying for a loan from a bank, it’s important to research and understand the different loan options available to you. This will help you make an informed decision and choose the loan that best suits your needs and financial situation. Here are some steps to help you in researching loan options:

1. Identify your loan requirements: Determine why you need a loan and how much money you need to borrow. This will help you narrow down the types of loans that are suitable for your needs.

2. Compare interest rates: Check the interest rates offered by different banks for the type of loan you are interested in. This will give you an idea of the cost of borrowing and help you choose the bank that offers the most competitive rates.

3. Consider loan terms: Review the terms and conditions of each loan option, including the repayment period, monthly installment amount, and any additional fees or charges. Ensure that the loan terms are favorable and align with your financial capabilities.

4. Evaluate eligibility criteria: Determine if you meet the eligibility requirements for each loan option. This may include factors such as your credit score, income, employment history, and collateral. Choose the loan options where you have the highest chances of approval.

5. Read customer reviews: Look for reviews and feedback from customers who have previously borrowed from the banks you are considering. This can give you insights into the quality of service, ease of the application process, and overall customer satisfaction.

6. Seek expert advice: If you are unsure about which loan option is best for you, consider consulting an expert such as a financial advisor or loan officer. They can provide personalized guidance and help you make an informed decision.

| Loan Option | Interest Rate | Repayment Period | Additional Fees |

| Personal Loan | 6.5% | 1-5 years | Processing fee: $50 |

| Mortgage Loan | 3.75% | 15-30 years | Origination fee: 1% of loan amount |

| Business Loan | 7.25% | 3-10 years | Annual maintenance fee: $100 |

Types of Loans

When it comes to borrowing money from a bank, there are several types of loans that you can consider. Each type of loan is designed to cater to different financial needs, so it’s important to understand the options available to you.

1. Personal Loans:

A personal loan is a versatile type of loan that can be used for various purposes, such as home renovations, debt consolidation, or unexpected expenses. These loans typically have a fixed interest rate and a set repayment period.

2. Mortgage Loans:

A mortgage loan is specifically designed to help people purchase a home. It involves borrowing a large amount of money, secured by the property being purchased. The loan is usually repaid over a long period of time, such as 15 or 30 years.

3. Auto Loans:

If you’re looking to buy a car, an auto loan can help you finance your purchase. These loans usually have fixed interest rates and a set repayment period. The car itself acts as collateral for the loan, meaning the bank can repossess it if you fail to make payments.

4. Student Loans:

Student loans are specifically designed to help individuals pay for their education expenses. These loans can come from private lenders or the government. They often have flexible repayment options to accommodate the borrower’s financial situation.

5. Business Loans:

Entrepreneurs looking to start or expand a business can apply for a business loan. These loans are designed to provide capital for business-related expenses, such as purchasing inventory or equipment. The terms and conditions of business loans can vary depending on the lender.

6. Credit Cards:

Although not technically a loan, credit cards are a form of borrowing money from a bank. They allow you to make purchases and pay for them later. It’s important to use credit cards responsibly and pay off the balance in full each month to avoid high interest charges.

Loan Terms and Conditions

When applying for a loan from a bank, it’s important to understand the terms and conditions that come with borrowing money. These terms outline the responsibilities of both the borrower and the lender, and they define the specific details of the loan agreement. Here are some common loan terms and conditions to be aware of:

Interest Rate: The interest rate is the cost of borrowing money and is expressed as a percentage of the loan amount. It determines how much you will ultimately pay back in addition to the principal amount.

Loan Amount: This is the total sum of money that you are borrowing from the bank. It is important to borrow only what you need and can comfortably repay.

Repayment Period: The repayment period is the time frame in which you are required to repay the loan. It may vary depending on the type of loan and can range from a few months to several years.

Repayment Schedule: The repayment schedule outlines the specific dates and amounts that you need to repay. You may be required to make monthly, quarterly, or annual payments, depending on the terms of the loan.

Collateral: Collateral is any asset or property that is used to secure the loan. If you fail to repay the loan, the bank may have the right to take possession of the collateral as a form of repayment.

Penalties and Fees: Loans may come with penalties and fees for late payments or early repayment. It’s important to understand these charges before signing the loan agreement.

Credit Requirements: Banks typically have certain credit requirements that borrowers must meet to qualify for a loan. This includes factors such as credit history, credit score, and income stability.

How to Loan in the Bank – Easy Steps

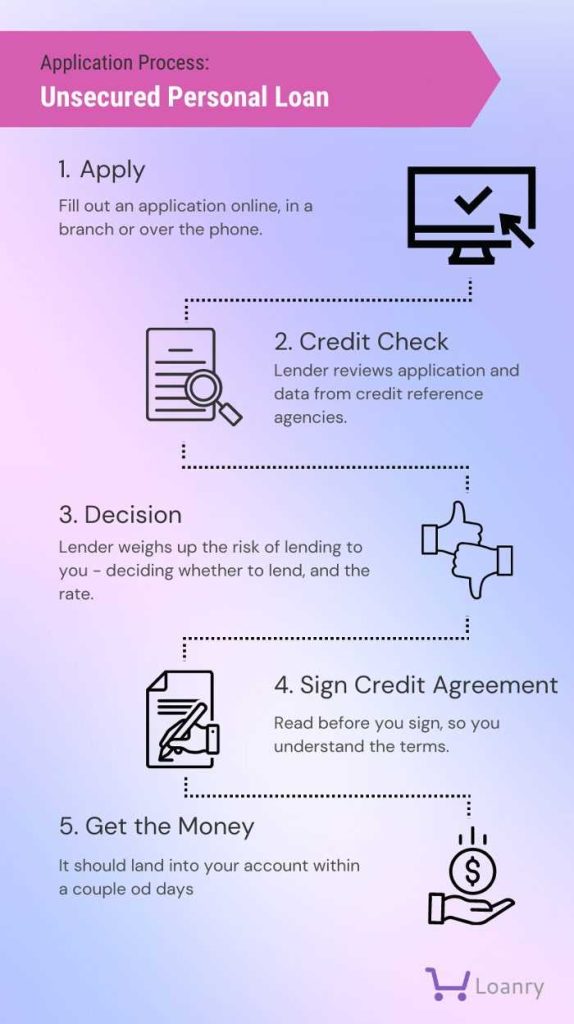

Applying for a loan from a bank can seem like a daunting process, but with some preparation and research, it can be a smooth and successful experience. Here are the steps to take when applying for a loan:

1. Determine your loan needs: Before applying for a loan, you should have a clear understanding of why you need the funds and how much you need. This will help you choose the right type of loan and determine the loan amount.

2. Research different banks: It’s important to compare different banks and financial institutions to find the one that offers the best terms and interest rates for your needs. Consider factors such as reputation, customer reviews, and loan requirements.

3. Gather the necessary documents: Most banks will require certain documents as part of the loan application process. These may include proof of income, identification documents, bank statements, and tax returns. Make sure you have all the required documents in order before starting the application process.

When applying for a loan from a bank, it is important to gather all the required documents to ensure a smooth and efficient loan application process. Here is a checklist of the documents you will typically need:

- Proof of identity: This includes a valid government-issued ID such as a passport or driver’s license.

- Proof of address: You will need to provide a document that shows your current residential address, such as a utility bill or a rental agreement.

- Proof of income: Banks will require documents that show your income sources, such as pay stubs, tax returns, or bank statements.

- Employment verification: You may need to provide documents that verify your employment, such as a letter from your employer or recent pay stubs.

- Bank statements: You will typically need to provide several months’ worth of bank statements to show your financial history and stability.

- Proof of assets: If you have any assets such as property or investments, you will need to provide documents that prove their value.

- Debt information: It is important to disclose any existing debts, such as credit card balances or other loans, as this can affect your loan application.

- Other supporting documents: Depending on the type of loan you are applying for, you may need to provide additional documents, such as business financial statements or legal documents.

4. Fill out the loan application: Once you have chosen a bank and gathered all the necessary documents, you can start filling out the loan application form. Be sure to provide accurate and complete information, as any discrepancies or missing details may delay the approval process.

5. Submit the application: After filling out the loan application, submit it to the bank along with all the required documents. Some banks may allow you to submit the application online, while others may require you to visit a branch in person.

6. Wait for the bank’s decision: After submitting your loan application, you will need to be patient and wait for the bank to review your application. The processing time may vary depending on the bank and the type of loan you are applying for.

7. Follow up with the bank: If you haven’t heard back from the bank within a reasonable timeframe, it’s a good idea to follow up with them to inquire about the status of your application. Be polite and professional when reaching out to the bank.

8. Review the loan offer: If your loan application is approved, the bank will provide you with a loan offer detailing the terms and conditions. Take the time to carefully review the offer, including interest rates, repayment terms, and any additional fees.

9. Accept the loan offer: If you are satisfied with the loan offer, you can accept it by signing the loan agreement. Make sure you fully understand the terms and conditions before signing, and don’t hesitate to ask the bank for clarification if needed.

10. Receive the funds: Once you have accepted the loan offer, the bank will disburse the funds to your designated account. Use the funds responsibly and make timely repayments to maintain a good credit history.

By following these steps, you can increase your chances of successfully applying for a loan from a bank and getting the funds you need to achieve your goals.

How to Complete the Loan Application in the Bank

When applying for a loan from a bank, it is crucial to complete the loan application accurately and thoroughly. This is your opportunity to provide all the necessary information to help the bank make an informed decision about lending you money.

Here are the steps to completing the loan application:

| Step 1 | Provide your personal information, including your full name, address, contact number, and social security number. It is essential to double-check the accuracy of this information to avoid any delays or mistakes. |

| Step 2 | Indicate the purpose of the loan. Whether it is for purchasing a home, starting a business, or consolidating debt, make sure to clearly state your intended use of the loan funds. |

| Step 3 | Provide details about your employment history, including your current job, the company you work for, your position, and your income. This information helps the bank assess your ability to repay the loan. |

| Step 4 | Disclose all your financial obligations, such as existing loans, credit card debt, or child support payments. By providing this information, you demonstrate your willingness to be transparent and responsible in managing your finances. |

| Step 5 | Include details about any assets you own, such as real estate, vehicles, or investments. These assets can serve as collateral or strengthen your loan application by demonstrating your financial stability. |

| Step 6 | Sign and date the loan application. By doing so, you confirm that all the information provided is true and accurate to the best of your knowledge. |

Remember that incomplete or inaccurate information on the loan application can lead to delays or even denial of your loan request. Take your time to fill out the application carefully and ask for assistance from bank staff if needed. Your diligence in completing the loan application will increase your chances of securing the loan you need.

What are the requirements for getting a loan from a bank?

The requirements for getting a loan from a bank may vary depending on the bank and the type of loan you are applying for. Generally, banks will require proof of income, a good credit score, and collateral for certain types of loans. It is best to check with the specific bank you are applying to for their specific requirements.

How long does the loan approval process take?

The loan approval process can vary depending on the bank and the complexity of your loan application. Generally, it can take anywhere from a few days to a few weeks. It is advisable to provide all the necessary documentation and information to the bank in a timely manner to speed up the process.

What should I do if my loan application is denied?

If your loan application is denied, there are several steps you can take. First, find out the reason for the denial and work on addressing that issue. It may be improving your credit score or providing additional documentation. Second, consider seeking a loan from a different bank or alternative lender. Lastly, you may want to consult with a financial advisor to explore other options or strategies to improve your chances of getting approved for a loan.

What is the first step to get a loan from a bank?

The first step is to identify the type of loan you need and gather all the necessary documents, such as identification proof, income proofs, and credit history.

Can I get a loan from a bank with a bad credit history?

Getting a loan from a bank with a bad credit history can be challenging, but not impossible. You may have to provide additional collateral or a co-signer to increase your chances of approval.

Leave a Reply